View Our Brand Assets

Access a suite of logos, fonts and media resources for the AdvisorEngine Brand. If you can’t find what you need, please contact us.

Access a suite of logos, fonts and media resources for the AdvisorEngine Brand. If you can’t find what you need, please contact us.

Access ETF models that combine expert decision-making with optimal implementation and management

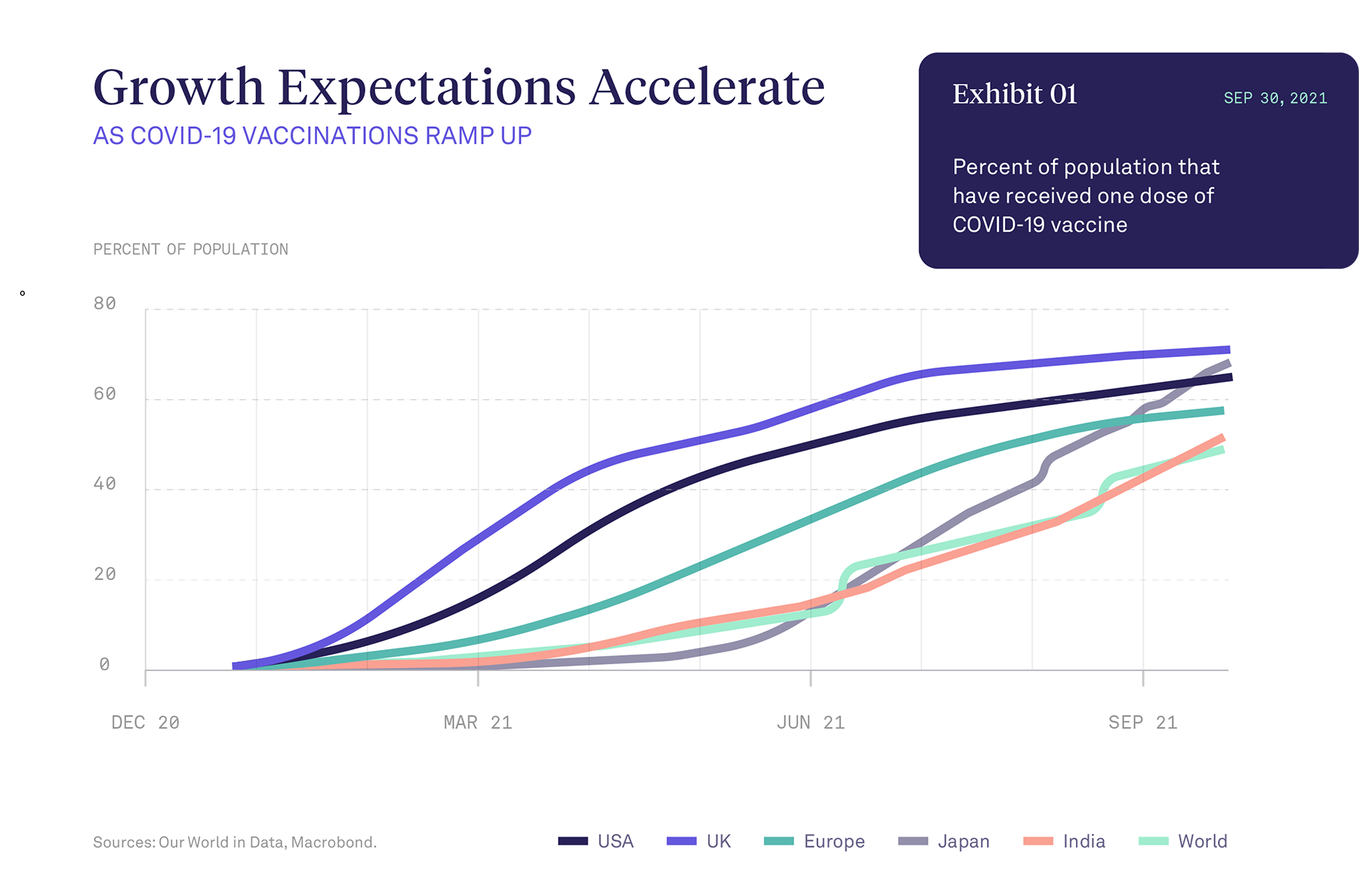

By combining Franklin Templeton's investment experience and resources with AdvisorEngine's wealth management technology, advisors and their clients are well-positioned to maximize the benefits models can provide.

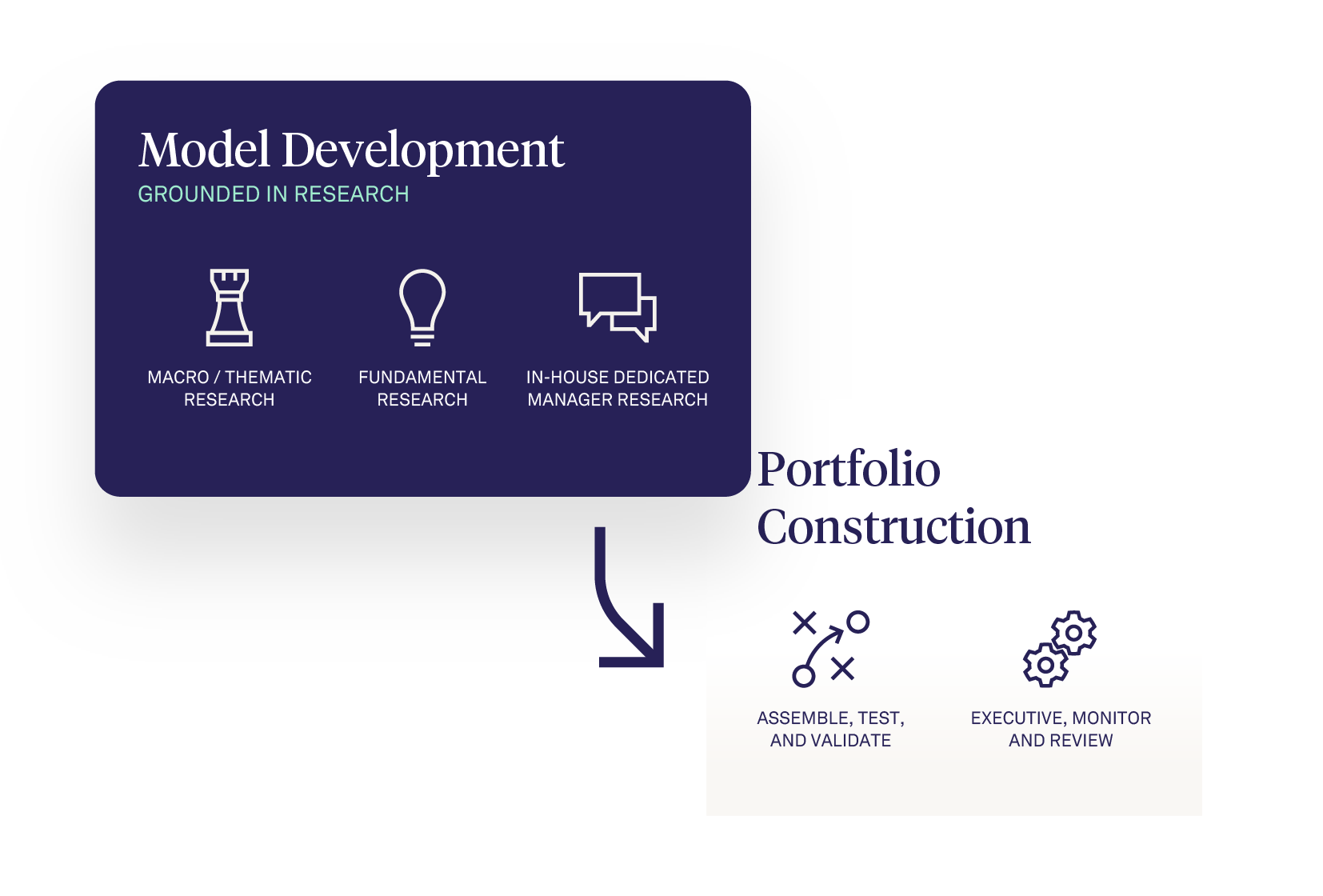

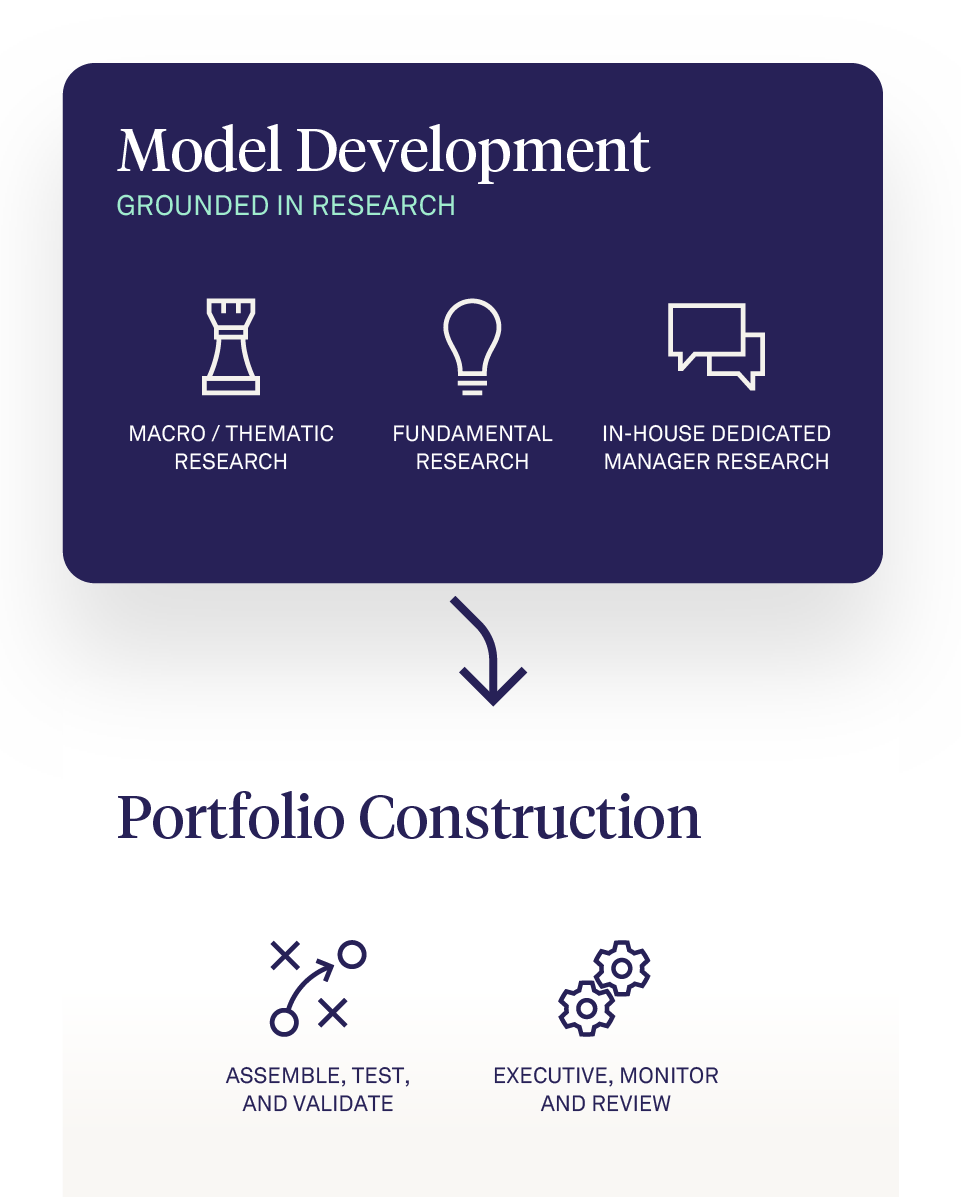

An open-architecture approach provides the FTIS team with ultimate flexibility as it selects underlying strategies based on targeted exposures.

Leveraging a mix of active and passive products, FTIS provides a range of strategies that can add long-term value for clients in a cost effective manner.

Utilize a range of core ETF portfolios which seek total return and achieve diversification potential by investing in a combination of active and passive funds from a variety of managers.

Access to actively managed portfolios focusing on sources of expected excess return with an anticipated trading frequency of 4–6 times per year depending on market conditions.

AdvisorEngine helps to optimize the operating environment for your firm's advisors and operations teams as unique financials goals are pursued for each and every client.

Access to frequent manager commentary, updates, and allocation changes make ongoing servicing a fast track.

As a technology company, AdvisorEngine® provides access to award-winning tools. AdvisorEngine does not provide broker-dealer, custodian, investment advice or related financial services. AdvisorEngine, Inc. is a subsidiary of FT FinTech Holdings LLC, which is a subsidiary of Franklin Resources, Inc., a global investment management organization operating as Franklin Templeton.