I spend my days digesting data. But my favorite treat is ice cream, so let me take you on a tour. Along the way, we’ll compare how an ice cream factory is like a wealth management data factory.

Setting the scene

Picture yourself in Waterbury, Vermont – home of the original Ben & Jerry’s ice cream factory that is one of the state’s top family attractions. You’re standing in a cold room behind a plate glass window…watching workers in neat, white uniforms stand monitor giant shiny stainless-steel vats with giant turning rotors on top that methodically churn the contents. The excitement of the kids in the room is palpable. (Let’s be honest – parents in the room are pretty fired up, too.)

Just as Ben and Jerry’s begins with the best possible ingredients and applies rigid quality standards to deliver a high-quality product, AdvisorEngine® uses a modern data factory to help you ingest, clean, normalize and analyze your data. Before you can review performance reports with a client, you need to trust that the information in the report is accurate and tailored to your needs. Much like a carton of ice cream, data must go through an ‘assembly line.’

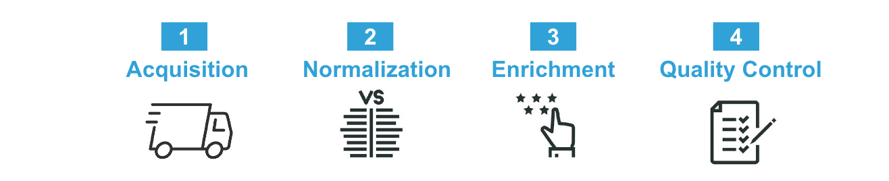

In ice cream and data, there are four basic steps – Acquisition, Normalization, Enrichment and Quality Control.

1. Acquisition: Gathering the ingredients

Ben & Jerry’s Ice Cream

Great ice cream requires great ingredients. Ben & Jerry’s works with dairy farmers across the country to procure fresh milk.

AdvisorEngine Data

Our first mission is to access data and start work on it. It’s our raw material.

We refer to access as acquisition which means bringing in the data each day and successfully submitting it without losing anything vital. We have in-depth data partnerships with custodians - their data sets include positions for each account; transactions; basic account descriptive data; open and closed tax lots; and security descriptions and prices.

The file structures and formats can vary enormously, but they all tell us the same things each day - what the accounts are, what they contain and what happened.

2. Normalization: Helping ensure consistency

Ben & Jerry’s Ice Cream

After milk is transported to the Ben & Jerry’s factory, it is then consolidated into four massive silos and stored at a standardized cool temperature. Then an expert called the “Mix Master” leads the mixing process – bringing together ingredients such as heavy cream, condensed skim milk, liquid cane sugar, egg yolks and cocoa. After being blended and pasteurized, the mixture enters the “Homogenizer” (pretty cool, right?) – which uses pressure to ensure consistent texture throughout the mix.

AdvisorEngine Client Data

Not only do our data sources use different file formats, they also use widely different formats to describe what’s happening. One might send a purchase transaction with the descriptive code “BUY”, while others use “BOT”, “BY” or even “PURCHASE.” Dates may vary also, ranging from “20190531” to “05/31/2019.” And positions can be identified with either ticker symbols or Cusips – a nine-character alphanumeric code that identifies financial securities for the purposes of facilitating clearing and settlement of trades.

Starting with simple transformations, AdvisorEngine’s data factory proceeds to normalize incoming data into internal standards - so that we can uniformly employ it. At present we have over six thousand potential transformations that can be applied to normalize data to a single standard.

3. Enrichment: Adding ingredients

Ben & Jerry’s Ice Cream

Once the mix has been cooled and mixed to the satisfaction of the “Mix Master,” the Ben & Jerry’s team makes the flavor magic happen by adding special ingredients. Whether it’s Cherry Garcia, Chunky Monkey, Half Baked, Phish Food or Chocolate Chip Cookie Dough…this step is where the flavor profile comes together.

AdvisorEngine Client Data

Enrichment at AdvisorEngine means adding value without altering the features of the data set. An example is when we get a transaction for a transfer to an account where no market value is available. Since we want this to help a client measure performance, enrichment will mean pinging our non-custodial data partners to get the data. We ask for and receive a price for the security, calculate the value of the flow and then generate more accurate performance data.

In this way, we have added value without changing the essentials of the event. But this requires caution. Enrichment rules have the potential to help clients get information not received in the custodial data feeds, so they need review to guard against adding incorrect data.

4. Quality control: Ensuring excellence

Ben & Jerry’s Ice Cream

Is there a better job in America than taste tester? Now comes the part where the quality assurance makes sure that every batch meets the Ben & Jerry’s standards of excellence.

AdvisorEngine Client Data

Even minor data issues early in the process can lead to growing consequences in the end process. Therefore, our approach is designed to help ensure quality control - monitoring the stages of the data assembly line.

We don’t just monitor inputs and processes, we also monitor the outputs. For example, our platform helps clients look at their performance measurement – generated daily by our system to help ensure our clients have access to quality data.

If a group of related accounts behave similarly except for one outlier, we look closely at the holdings and events to see what stands out to try to explain the “why” behind it. Sometimes outlier returns are accurate due to the circumstances of the account, but sometimes intervention and corrective action are needed.

We have confidence in our processes but we work to smarten them – we remain in an agile cycle of self-improvement, while retaining that element of personal oversight and judgment. Algorithms are fast, yet they aren’t necessarily wise.

The end product

Ben & Jerry’s Ice Cream

The result speaks for itself...I might need to open a pint right now. At any given time, there are approximately 50 flavors of delicious Ben & Jerry’s ice cream available for purchase.

AdvisorEngine Client Data

At the end of our assembly line, our finished product is unveiled through our advisor platform and client portal. For all the sophisticated modeling and attribution analysis that can happen, the rubber meets the road when an advisor and an account holder can see what is in an account and how well it has performed. This is where the most essential relationship between financial advisors and clients gets cemented. We are here to efficiently and effectively deepen these connections.

Likening our data movement to a data factory is a helpful analogy for understanding what we do at AdvisorEngine. Much like Ben and Jerry’s, we are very proud of our product. There is only one essential difference AdvisorEngine can’t match: at the end of the tour, their free samples simply taste better!

Sample our product today by scheduling a demo. Don’t miss out on the flavor of high-quality data standards that can drive growth for your financial advisory business today.

This blog is sponsored by AdvisorEngine Inc. The information, data and opinions in this commentary are as of the publication date, unless otherwise noted, and subject to change. This material is provided for informational purposes only and should not be considered a recommendation to use AdvisorEngine or deemed to be a specific offer to sell or provide, or a specific invitation to apply for, any financial product, instrument or service that may be mentioned. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Opinions and forecasts discussed are those of the author, do not necessarily reflect the views of AdvisorEngine and are subject to change without notice. AdvisorEngine makes no representations as to the accuracy, completeness and validity of any statements made and will not be liable for any errors, omissions or representations. As a technology company, AdvisorEngine provides access to award-winning tools and will be compensated for providing such access. AdvisorEngine does not provide broker-dealer, custodian, investment advice or related investment services.