The mission of Action! Magazine is providing actionable content for wealth management leaders.

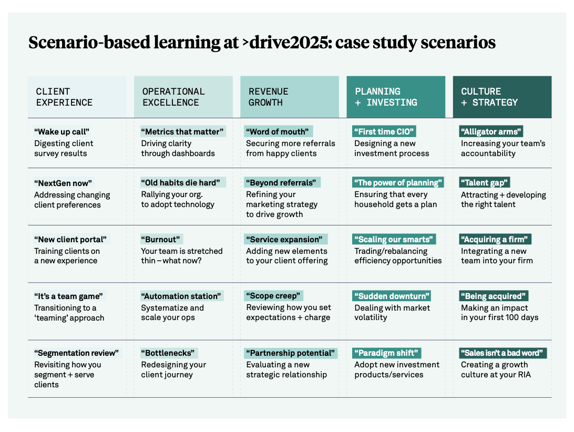

So I am proud to introduce a new content format that furthers this mission: scenario-based case studies.

The following case study is inspired by a real-life situation. To protect confidentiality and promote open dialogue, details have been anonymized and presented as part of a fictional firm – “ABC Advisory.”

You, dear reader, have been hired as a Consultant to advise the team at ABC Advisory. What would you recommend they do to address their Client Experience issues?

Scenario overview

By all outward-facing measures, ABC Advisory has been performing exceptionally well. For 12 years consecutively, the firm has achieved record assets, record revenue and record profits. Last year, they were named to the Barron’s Top 100 Financial Advisors list for the first time.

By all outward-facing measures, ABC Advisory has been performing exceptionally well. For 12 years consecutively, the firm has achieved record assets, record revenue and record profits. Last year, they were named to the Barron’s Top 100 Financial Advisors list for the first time.

But ABC Advisory has a problem underneath the surface. In a recent survey, its clients ranked them poorly in several key areas. The results were shocking to the team. Talk about a wake-up call.

A new hire hits the ground running

Earlier this year, Cameron was hired at ABC Advisory in a newly created position: Head of Client Experience.

During her interview process, she was energized by the company’s strong core values and shared commitment to delivering for their clients. She was also drawn to the CEO’s clear articulation of what future growth could look like over the next 10 years.

In her first month on the job, Cameron’s first order of business was interviewing colleagues. These conversations were universally positive – employees at ABC Advisory all believed they were doing right by clients. It made her feel proud to be a member of the team.

In her second month on the job, Cameron focused on soliciting the voice of the client. She designed a comprehensive “Client Experience Survey” and distributed it across the client base at ABC Advisory. This is when things got a bit rocky. The survey results were decidedly mixed.

Survey results

On the positive side, clients rated the firm highly in several categories, including:

- Trust. Clients believed that ABC Advisory put their interests first.

- Financial Planning. Clients appreciated the planning work that ABC Advisory does on an annual basis.

- Value. Clients agreed that they receive fair value compared to the price they are paying.

However, clients rated ABC Advisory surprisingly low in other important areas, such as:

- Convenience. Clients shared that working with ABC Advisory was ‘clunky’ and ‘slow.’ People indicated that they would be more likely to invest more money with ABC Advisory if they made it easier to do so.

- Responsiveness. Clients felt that ABC Advisory was slow to respond to important questions. Also, they lacked trust in their follow-through, citing that ‘things sometimes slip through the cracks,’ forcing clients to follow up because ‘the ABC team doesn’t always own issues until they are resolved.’

- Proactive Communication. Clients felt that their advisor didn’t always keep them up-to-speed on their financial life journey, how market changes impacted their portfolio or specific actions that ABC Advisory is taking to mitigate risk or take advantage of emerging opportunities.

- Information Accessibility. Clients shared that it was difficult to know ‘Where I should go to get the information I’m looking for,’ sharing that ABC Advisory’s technology is ‘dated’ and ‘honestly confusing...due to multiple Client Portals with multiple log-ins.’

- Serving the Next Generation. Clients did not feel that their advisor made an effort to engage with their full family on financial planning, such as discussing matters with their children to help build financial acumen.

Sharing the results

When Cameron shared the results with her team, the room got quiet. After people reflected for a few minutes, they shared their perspective:

- "This feels like a gut punch. It’s a truly unnerving feeling, and I’m just sick over it. How did we get here? When I stepped back from having client meetings directly, this is not what I expected to happen." – CEO, Sam

- "I am reflecting on how I can help. At times, I feel a bit disconnected from client sentiment since I am so plugged into the markets. I need to do a client roadshow soon so that I can be out front and directly hear- ing what is on clients’ minds." – CHIEF INVESTMENT OFFICER, Chandler

- "I’ve been busy, so I haven’t gone through the details yet. I will say...certain clients will never be happy, honestly. So we should probably take these results with a grain of salt." – ADVISOR, Alex

- "I’ve had a sense of this for a while, but it’s hard to get people to pay attention to it. I’d like to add more people on the Client Service side of things so that we can raise the bar on our responsiveness times." – COO, Shannon

At the end of the meeting, the leadership team agreed that action was needed immediately. They cleared their calendars for a full-day offsite the following week. They needed to get to the bottom of things. What was the true root issue? Complacency? Arrogance? Ineffective training of new hires? Bad process? Subpar technology adoption? Something else?

What would you do?

- What steps should ABC Advisory take?

- Have you ever had a situation where you received challenging feedback from a client? What happened? What did you learn and do differently moving forward?

- What does a satisfied client look like to you? Does your firm measure client engagement/client satisfaction/NPS? If so, how?

My perspective

When things feel overwhelming, it’s time to simplify. I would recommend a 3-step path forward for Cameron and team. First: take stock. (They are in the middle of this step right now. Now, they must gain sharper clarity on the true root causes behind the client experience issues.) Second: build an action plan, including individual accountability for each desired result. Third: execute against the plan.

The team at ABC Advisory has their work cut out for them. The good news? Their team trusts one another, and they are motivated to act now. Even the most successful RIAs face adversity. What separates the best firms is their ability to bond together and overcome challenges.

We'd love to see you at >drive2025. Click here to learn more.

This blog is sponsored by AdvisorEngine Inc. The information, data and opinions in this commentary are as of the publication date, unless otherwise noted, and subject to change. This material is provided for informational purposes only and should not be considered a recommendation to use AdvisorEngine or deemed to be a specific offer to sell or provide, or a specific invitation to apply for, any financial product, instrument or service that may be mentioned. Information does not constitute a recommendation of any investment strategy, is not intended as investment advice and does not take into account all the circumstances of each investor. Opinions and forecasts discussed are those of the author, do not necessarily reflect the views of AdvisorEngine and are subject to change without notice. AdvisorEngine makes no representations as to the accuracy, completeness and validity of any statements made and will not be liable for any errors, omissions or representations. As a technology company, AdvisorEngine provides access to award-winning tools and will be compensated for providing such access. AdvisorEngine does not provide broker-dealer, custodian, investment advice or related investment services.